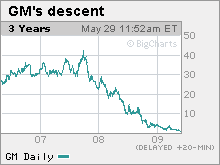

GM moves step closer to bankruptcy

Company announces that few bondholders were interested in a plan to swap debt for stock. New ownership stakes take shape: U.S. to get nearly 70%.

NEW YORK (CNNMoney.com) -- General Motors said Wednesday that it has fallen far short of the bondholder support it needed for its proposed debt-for-stock offer, virtually guaranteeing that the nation's largest automaker will be forced to file for bankruptcy court protection within the next five days.

The bondholders were not satisfied with the prospect of owning only 10% of the company when the U.S. government would own nearly 70% and a union-controlled trust fund up to 20%.

The bondholders own $27 billion in corporate notes. GM (GM, Fortune 500) needed owners of 90% of those bonds to accept stock in return for the debt in order to reduce its interest expenses to a more manageable level.

But GM's announcement said that bondholders who took the company's offer were "substantially less than the amount required."

The company owes the bondholders $1 billion in interest payments on June 1 - money it says it does not have.

The company also faces a June 1 deadline to win concessions from its union, creditors and other parties or be forced into bankruptcy by the U.S. Treasury Department, which is funding GM's operations through direct federal help.

"The GM board of directors will be meeting to discuss GM's next steps in light of the expiration of the exchange offers," said the company's statement.

You can read the rest here (or any other news site for that matter)http://money.cnn.com/2009/05/27/news...ion=2009052707

Company announces that few bondholders were interested in a plan to swap debt for stock. New ownership stakes take shape: U.S. to get nearly 70%.

NEW YORK (CNNMoney.com) -- General Motors said Wednesday that it has fallen far short of the bondholder support it needed for its proposed debt-for-stock offer, virtually guaranteeing that the nation's largest automaker will be forced to file for bankruptcy court protection within the next five days.

The bondholders were not satisfied with the prospect of owning only 10% of the company when the U.S. government would own nearly 70% and a union-controlled trust fund up to 20%.

The bondholders own $27 billion in corporate notes. GM (GM, Fortune 500) needed owners of 90% of those bonds to accept stock in return for the debt in order to reduce its interest expenses to a more manageable level.

But GM's announcement said that bondholders who took the company's offer were "substantially less than the amount required."

The company owes the bondholders $1 billion in interest payments on June 1 - money it says it does not have.

The company also faces a June 1 deadline to win concessions from its union, creditors and other parties or be forced into bankruptcy by the U.S. Treasury Department, which is funding GM's operations through direct federal help.

"The GM board of directors will be meeting to discuss GM's next steps in light of the expiration of the exchange offers," said the company's statement.

You can read the rest here (or any other news site for that matter)http://money.cnn.com/2009/05/27/news...ion=2009052707

Comment